By Jamie Brown-Hansen

“Anytime you want to understand something, [like] why is such-and-such happening, why is there a biodiversity crisis, or why are we drilling for more oil when it’s polluting the atmosphere and causing oil spills…you ask ‘why’, and down a couple levels of ‘why’ you always get to money.” — Sacred Economics with Charles Eisenstein, A Short Film

A recurring theme in the biomimicry track of this year’s SXSW Eco conference was the increasing multidimensionality of ways biomimicry is being applied not just to products, but also to processes and systems. Chemistry, investing, leadership, branding: all can be bioinspired. I’m enthusiastic about applying biomimicry to financial architecture, or the architectures of exchange. Biomimicry offers a new language, longer timeframe, wider lens, and better-rooted framework overall for thinking about system design. It allows us to finally step “outside” (literally and figuratively) the narrow conceptual models of finance that are currently sinking our collective ship. How would nature design a financial system? This blog post is adapted from a short presentation I gave at SXSW Eco on this question.

I recently heard an MIT business professor introduce finance to his students as the “lifeblood” of business. A number of biological metaphors can be interesting and useful for thinking about financial architecture, but this is probably the most common one. We tend to think of finance as a kind of circulatory system that delivers economic oxygen to our businesses through this medium we call money. How would nature make sense of the “lifeblood” that currently animates our financial models?

Bank Credit’s Expansionary Triumph

Any time we talk about a funding strategy, or a financial model, this is really code language for embedding ourselves in a credit system. Money today is credit. All of our conventional sources of funding, whether dollars or euros or yen, come into existence through a giant credit facility otherwise known as the banking system. This is now a single, globally integrated, globally homogenous system with its headquarters where I live here in Basel, Switzerland. Core innovations in the design of this system are now templated first at the global level, and make their way down to national-level implementation thereafter. It is a top-down, monoculture model.

The technologies of money, credit, and exchange that culminated in this banking monolith facilitated a 5,000-year expansionary growth phase of our human species. These are key innovations that, alongside others in agriculture, navigation, energy and so forth, enabled us to expand from small tribes into global empires and, ultimately, into a single global economic superorganism. Before money and credit, we could only be interdependent within close networks of people we directly knew and trusted, otherwise known as our tribe. With money and credit, we no longer needed to directly know and trust our trading partners so long as we trusted their money. The size of economic communities could therefore expand beyond the tribal. Rival processes of monetized expansion then continued for some 5,000 years thereafter. In the end, bank credit triumphed precisely because its design is premised on quantitative expansion and nothing else. Banks issue credit for any project promising expansion, a quantitative return. Thanks to its success, we are now a global superorganism.

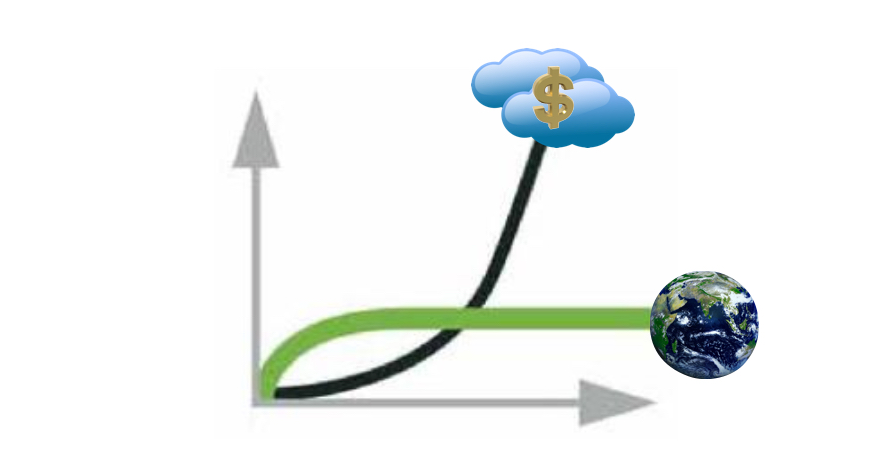

Having encompassed the globe, however, conventional finance is running out of space in the material realm to expand into at the rate it is designed to expand. As a result, it is rapidly moving into the only realm where quantitative expansion can last forever, which is virtual reality. This is how we’ve ended up today with a financial derivatives trade valued at anywhere from 10 to 20 times the GDP of the entire planet. Meanwhile, real-world communities back on the ground, which cannot grow forever (this being a non-negotiable parameter of biological existence), are increasingly left in a monetary vacuum.

Community Credit Emerges

A vacuum is a powerful invitation for something new. What we can see today, if we choose to look for it, is a global permaculture of community credit systems emerging on the ground, from the bottom up, below the canopy of established finance. These systems, which could also be called community-based mutual credit systems, are consistent with biological design principles in all the ways bank credit is not. They are bottom-up, locally attuned and adapted, decentralized, diverse, self-organized, iterative and modular – in short, everything we dream of from a biological design perspective. Perhaps most important, these systems are not premised on quantitative expansion; instead, we could say they are premised on qualitative expansion, with quantitative stability over time. This is consistent with the design of mature biological systems and the phase our species is moving into now, as we reach the limits to our own growth.

Community credit, however, is currently a global landscape of local credit facilities. This is not yet a global credit facility. It is easy to offer community credit within a local network of trust. It is much harder to offer community credit for something you’d like to order from China. So the interconnection of these facilities is the next piece in the puzzle that can make this a viable alternative to bank credit as a global medium of exchange, and that’s what we’re focused on today.

Forming the Credit Commons

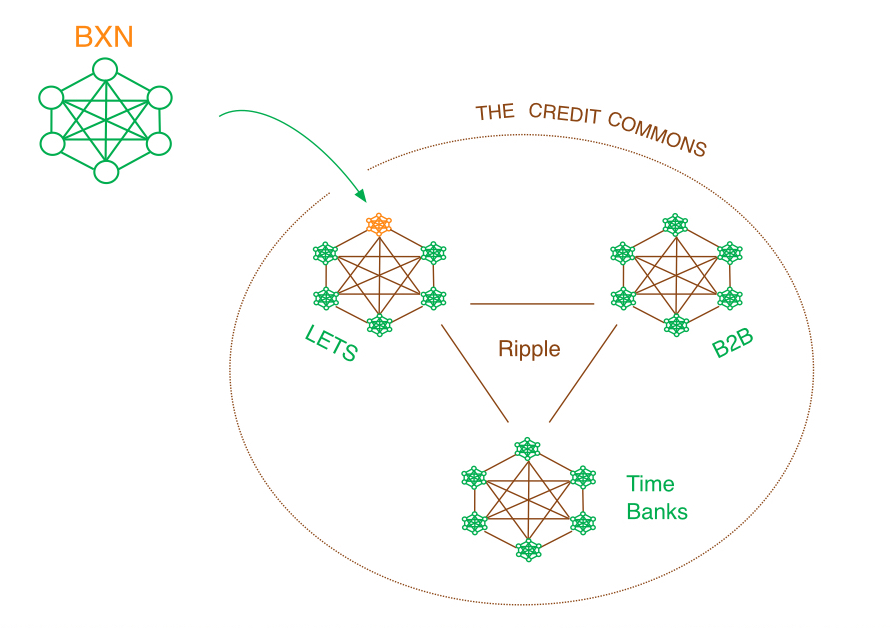

Like the natural world itself, the community credit landscape is diverse and dynamic and will never be fixed in a single pattern. That said, it is possible to recognize three distinct cultures that have emerged among these systems so far. They are LETS (Local Exchange Trading Systems), Business-to-Business (B2B) trading systems, and TimeBanks. Each of these groups organizes somewhat differently and uses different systems, but they’re all premised on the same basic principle of mutual credit exchange. A community credit facility results any time a group of people or organizations comes together and agrees to directly issue credit to each other for their own goods and services. (Some groups have a different way of describing this, but the result is the same.) This is usually called mutual credit, and it’s the most democratic form of credit creation: we issue credit ourselves backed by our own promises to redeem it in the future. Organize these promises together, and you’ve got a bottom-up credit facility.

There are now thousands of these worldwide, but they are not yet interoperable with each other. The next great design challenge facing the system engineers in this space is to develop import/export software extensions and protocols that would be compatible with each of the major systems currently used by the three trading groups. Their goal is to leave the design elements of the local systems intact, meaning the extensions wouldn’t compromise the sovereignty of communities over their local design choices. What they would do is allow the systems to communicate with each other using another connecting system, most likely Ripple. The result will be to achieve a larger “credit commons” through the interconnection of local credit facilities as long envisioned by mutual credit advocate Tom Greco. The developers estimate that this could be technologically feasible within the next two years.

Meanwhile, the Biomimicry Global Network (BGN) is entering this space with its own prototype LETS, with our own vision of where this can go in the future. It’s currently called the Biomimicry Exchange Network (BXN), though the name may soon change. I’m most excited about the possibility of a future trading agreement between the global biomimicry credit facility and the global ecovillage credit facility, now in development by the Global Ecovillage Network (GEN). To my mind, the biomimicry and ecovillages communities are a match made in evolution: one builds bridges between human and natural design, the other roots into the ground.

The Money “Maker” Movement

We can think of community credit as another aspect of the maker movement, which the biomimicry community has been following because we’re interested in the development of localized 3D printing. The maker phenomenon can happen in any sector, however, not just manufacturing. The technologies of community credit are to financial architecture what 3D printing is to manufacturing. In both cases, these are breakthrough technologies that are already proven but not yet mass market; they localize and democratize our economic processes; and they open up new dimensions of biomimetic potential that weren’t previously available in either realm, production or credit creation.

The technologies of community credit have reached the point where the experience of creating a credit facility is a lot like creating a website. You don’t need any prior technical experience; if you want a website, you can go to WordPress or Squarespace or the like, sign up for an account, start making your design decisions, and within two hours you’ve got a website. If you want a community credit facility, you can go to Community Forge or CES (Community Exchange Systems) or Cyclos or the like, sign up for a system for free, start making design decisions like unit of value, credit limits, and whether you want an element like a tax, an interest rate, demurrage or a transaction fee; and within a couple of hours you’ve got a credit facility.

“Small can be beautiful, and evolution starts small.”

It’s a lot of fun to go through this design process, to unleash the collective credit power of your own community and then discover and “imagineer” the many ways you can apply this power. (It can also be a great practical learning experiment for a class of economics students!) However, it’s not necessary to create a new facility in order to join the money “maker” movement. It’s always easiest to join a system that already exists, such as the LETS, TimeBanks or B2B systems in your local networks. Try a web search for these, and join one where it makes sense for you.

The largest LETS platform is CES out of South Africa, used by more than 800 communities worldwide. German-speaking communities have been fond of Cyclos, and for the biomimicry LETS, we chose the Community Forge system, based in Geneva and popular among French-speaking communities. For businesses, a Canadian system called Collective Currency (based out of Barbados for tax reasons) is interesting in that it allows membership to be paid in barter credit rather than conventional money. Koina is a new option for businesses still in development that might be worth keeping in mind for the future.

Most of these systems currently operate on a scale that is microscopic compared to the volume of exchange still happening within the bank credit system. (That said, B2B transactions can be very large, sometimes involving giant trades among multinational corporations.) Small can be beautiful, however, and evolution starts small. Money is a collective technology, so the choice to move into community credit becomes more substantial with every person, community, organisation and business that makes this decision.

We Are the Pump

The popular metaphor of money as the “lifeblood” of the economy is effective in more ways than one. My favorite illustrates the idea that was expressed by E.C. Reigel when he wrote, “you have not suspected that the money power resides in you.”

We were all taught that the heart is a pump. If you google “the heart is not a pump”, however, you’ll find a variety of sites and sources claiming we have been biologically misinformed about the role of the heart. The heart is an information and exchange centre, critical to life, infusing oxygen into blood, reading the body and sending signals to the brain, but some claim its mechanics actually slow down the momentum of blood flow. Pumping starts in the circulatory system of a developing embryo before a heart even forms. It is a distributed phenomenon throughout the system of veins and arteries that begins as individual blood cells start to pulsate in unison. Ultimately, most of the mechanical power comes from the region of the gut.

We have the same misconception about monetary circulation in the body of the economy. We tend to think of banks as the power, the engines of money, but they’re not. Money’s circulation is powered by our acceptance of it in the payment of goods and services, and this is a distributed phenomenon throughout the network of veins and arteries of the economy. A monetary system collapses not when banks collapse, but when people stop accepting the money. We are the pump. The buck starts here.

“A monetary system collapses not when banks collapse, but when people stop accepting the money. We are the pump. The buck starts here.”

Community credit is already available to us. A financial system conducive to life is now a matter of collective choice, much like the choice to eat organic. We can have organic options available, but if nobody prefers them, they don’t make a difference. Once we can recognize the organic option for a medium of exchange, we can then consciously choose to step into those options wherever they are available. Any family or business or organization that puts a sticker on its window saying, “we prefer community credit” becomes part of the pumping mechanism for a new kind of economic circulatory system that might just keep us alive on this earth. The more “cells” pulsating in unison with this choice, the more able we are as a species to gradually shift the weight of our interdependence out of bank credit and into community credit until, one day, our mature, stable phase may arrive.

About the author:

Jamie Brown-Hansen is a community credit architect and biomimicry specialist in Basel, Switzerland, and a managing partner of Biomimicry Switzerland. You can learn more about her work at consciousevolution.ch

This is a wonderful presentation noting first the real world impossibilities of the current economic system and exploring models that are compatible with natural laws (can’t grow forever). The common denominators of the 800+ referenced complimentary currencies were not clear to this novice, Two areas warranting further exploration and encompassing portions of my work include the priority that complimentary currencies insulate what we in the US call Main Street from Wall Street. Let the gamblers play their games but when the bubble bursts, limit the impact on Main Street. It is my understanding that each day $5 Trillion are traded on the global market of which only 2% represents transfer of real world goods and services. In such a system any adverse financial impact is bound to rumble through the real world economy too.

The second point I would humbly offer is that the alternate currency that could be applicable to all situations and consistent with Nature is a currency based on the environmental and social impact of the goods and services traded.

My personal work for the past 7 years has focused on development of such a system that could make available to the consumer (who in most nations accounts for 70% GDP) the complete environmental and social footprint even adapted to a personal priority scale. This would allow consumers to use purchasing power to promote sustainability rather than relying on government regulations or corporate fiat. I invite you to visit our work at http://www.earthaccountig.com. Twitter and Facebook sites are available as well.

Bruce P. Hector MD

CEO, Earth Accounting