What Comes after Capitalism? - That is the Wrong Question

Paper presented at the 2nd International Conference on Complementary Currency Systems (CCS), 19 - 23 June 2013

By Tim Jenkin

Humanity is confronted with many converging crises that together present a challenge greater than anything faced before. These include resource depletion, resource wars, global warming, environmental pollution and destruction, declining biological diversity, stalled and collapsing economies, escalating debt, increasing inequality, population overgrowth, social breakdown, and many others.

While these crises are usually ascribed to multiple causes, there is growing consensus that global Capitalism bears prime responsibility and therefore its replacement with a more benign economic system is urgently required. Many alternative economic systems have been proposed, which creates another dilemma: which one to choose?

But is blaming something as abstract as an entire economic system useful in explaining humanity's woes, or is there something deeper that explains the human activities and behaviours that have resulted in these crises? In any case is it possible to replace one economic system with another, especially when the prevailing one operates over practically the entire face of the earth? And who can predict that a new economic system is going to solve the problems and not create additional ones, or degenerate into something resembling present-day capitalism or even something worse? Who will decide which of the alternatives will be best, and how will it be introduced or imposed in the face of huge vested interests wishing to preserve the status quo. And do we want a new monolithic economic system that replaces global capitalism?

Replacing one economic system with another implies that new economic systems can be designed or that there are 'off-the-shelf' models that can be implemented. It also implies that economic systems can be 'switched off' and new ones can be 'activated' in their place. As such we must assume that economic systems are detached from the physical realities to which they apply. How would a new economic system deal with the physical reality left behind by capitalism, which has utterly shaped our world and in turn shapes capitalism? Does there need to be a revolution that completely destroys the institutions and physical reality of the old before applying the new? If the latter, where are we going to find the energy and resources to rebuild everything in an energy and resource depleted world? How will everyone survive while the new system is being built, and will planet earth recover from such destruction and reconstruction anyway?

Many would argue that in order to replace an economic system there needs to be political change first. A new political order would be able to create new rules and rearrange social and economic institutions to create a less destructive and more sustainable economic system.

The trouble with this argument is that there are no political entities capable of challenging the ones upholding global capitalism. It is the global system that needs to be changed, not just a local change here or there. There might be a few instances where it is said that capitalism does not hold sway, but such places, whatever their economic systems are called, are still locked into the global system and contribute to the global crises in equal measure.

There is also no consensus among alternative political groupings about how the new economic system should work. Global capitalism is a unitary, interlocked system dominated by huge financial institutions and corporations, which dominate the governments where they operate. There is thus no point in appealing to governments to bring these institutions under control or to reform the current economic system so that it will deal effectively with the impending crises.

While disastrous economic collapse is a certainty if the current global economic system continues unchallenged, the notion of replacing it with another is an absurdity. An economic system, like any system, is a set of interacting or interdependent components forming an integrated whole. Therefore it is the components and the way they interact that need to considered, not the whole, which is a manifestation of the working of the system.

Therefore, to ask what comes after capitalism is entirely the wrong question. As I will attempt to show, economic systems do not inevitably evolve to 'higher levels' by overcoming their contradictions, and at this juncture we should not be seeking new economic systems that will unleash even greater wealth producing powers than the present one.

Our attention should rather be focussed on creating new 'operating systems' that will serve as the foundation for sustainable, parallel economic systems that will operate within the ecological constraints of a finite earth.

Social and Economic Evolution

Theories of social and economic development usually describe the path followed by humanity from its scavenging and hunter-gatherer origins to present day capitalism in terms of a linear progression of increasingly 'advanced' modes of production or economic systems. The evolution along this path is usually described as inevitable or natural, even though different societies may advance along it at different times and speeds. Each stage is said to be more evolved or developed than the previous one in that it is able to generate greater quantities of wealth. This is described as social and economic 'progress' or 'development'. The mission of economic history, we are told, is to explain growth. [Road to Riches - or the Wealth of Man, Peter Jay, 2000, p.8]

From our current historical perspective these theories are beginning to look increasingly shaky. Economic, social and environmental collapse brought about by reaching physical limits is not catered for in these theories of permanent growth and evolution to higher levels. Some societies never follow this path at all and it could be said that most would never have followed it if it had not been forced on them by invasion, occupation, colonialism and imperialism.

Most theories of development also adopt a thoroughly Eurocentric point of view, taking what happened in Europe as a template that can be applied to the rest of the world. These theories are used for predicting or driving the direction of development in parts of the world said to be 'undeveloped' or 'underdeveloped'.

What is becoming clear now is that this 'development' model probably has as its next stage the complete collapse of 'civilisation' as we know it, taking most of humanity back to a pre-industrial stage in a devastated and depleted world where only very few humans will be able to survive, and that is assuming that most life forms are not wiped out in some kind of nuclear holocaust.

Should humanity survive, it will be those societies that never embarked on the industrial path that will be shown to be the most 'advanced', not the ones that relied on fossil fuels, believed in infinite growth and did not acknowledge environmental limits.

What this tells us is that it is not very useful to explain human development in terms of the increasing complexity of economic systems, or to believe that economic systems always evolve to 'higher levels' characterised by increasing complexity, uniformity, interdependence and ability to produce ever greater quantities of wealth. Similarly, comparing societies in terms of the complexity of their economic systems and levels of their physical production is no measure of how 'advanced' they are relative to each other. The only way to determine this is to use biological criteria: the ones that are most 'advanced' are those that are the most adaptable, resilient and sustainable.

In the coming world of resource scarcity the most 'advanced' economic systems will be the ones consuming the least energy, meaning that they have rolled back industrial production and become reliant on local resources and talents. Localisation means a reduction in scope of economic systems and therefore an increased diversity of types - a reversal of the current trend towards uniformity and globalisation.

There are many theories about how societies move from one stage to the next. Most attempt to explain transition in terms of population growth, pressures on resources, environmental problems and advancing technologies. Others explain it in terms of conflict between competing social classes attempting to improve their position relative to others. All of them assume an innate desire in humans to improve their well being, and this is said to provide the motive force driving societies to overcome the barriers preventing the production of more wealth. When the barriers are overcome, society moves on to a new economic system.

This places the emphasis on production, and therefore on economic systems. Economic evolution is described in terms of a series of ever more advanced 'modes of production', which are able to produce greater quantities of wealth over their predecessors.

If the assumption is removed that humans naturally seek to improve their economic well-being by producing more, another explanation for economic change is required.

This paper makes no assumptions about the driving forces of history but what is becoming apparent, as human society comes up against physical limits, is that the next stage will be one that is in contradiction with these theories of 'progressive development'.

What this paper does attempt to do though, is show that in order to make suggestions about ways forward from capitalism it is more useful to consider the exchange relationships that people enter into in the process of producing their means of existence than their productive relationships.

Certainly, in the sequence of events, production comes before exchange and so it seems that exchange relationships are secondary and a consequence of productive relationships, but production always takes place in a context of already established exchange relationships.

While this appears to be a chicken and egg situation, the matter is clarified if we consider any situation in which people decide to achieve some common end: the productive relationships they enter into are determined by how they intend to share and exchange the product of their efforts. The intention to share and exchange comes before production and people would not enter into productive relationships if they saw no benefit in doing so.

Exchange relationships can be defined as those which determine how the product of combined effort is shared, exchanged or distributed. The matrix of exchange relationships that exist in a society and the rules that govern their operation can be called its exchange system, and in this paper the exchange system is considered as the 'operating system' of a society.

In computing, operating systems define how digital devices work, and changing the operating system can change the entire user experience using the same hardware.

This same concept can be applied to societies, and it is the contention of this paper that in order to overcome the huge crises facing humanity it is more important to consider new 'operating systems' than finding ways of replacing or reforming an economic system that has brought humanity to the dangerous situation in which it finds itself.

Exchange Systems

The concept of exchange systems is not one that is frequently encountered in mainstream economic literature. It is more likely to be found in anthropological writings to refer to the different modes of exchange encountered in traditional societies. Today it is increasingly used in alternative economic literature as a container concept for all forms of exchange, not just monetary exchange.

Exchange here is defined in the broadest possible way to mean the exchange of energies by living organisms. By such a definition, sharing is a form of energy exchange where each agent contributes energy to achieve a greater result in order to consume energy from the collective output.

Exchange is a property of life on earth and not something unique to humans, but humans have developed forms of exchange that go beyond mere sharing, allowing them to exchange energies in an organised way in time and space. Organised exchange results in exchange systems, which provide the rules and logic and establish the relationships that guide activity in the various social realms in which they operate.

An exchange system is essentially a social facility and they exist in all social groupings, from the smallest family clans to entire nations. A society without an exchange system is an impossibility for exchange is what defines humanity and in fact makes productive life possible. Only Robinson Crusoe had no exchange system.

Throughout history humans have discovered and employed many different ways of sharing and exchanging their energies and hence many different exchange systems have evolved. , providing the means to exchange in time and space and to maintain balance between contributions and receipts.

In all societies several exchange systems operate simultaneously, each one in a different realm of life. Usually the one that operates in the realm where the society produces its means of existence becomes dominant and defines the overall nature or ethos of the society. It sets up the most enduring relationships and defines how people cooperate or compete, set priorities, decide what to produce and how to produce it, and how it is distributed. Economic systems are manifestations of the underlying exchange systems, which constitute the 'operating system' of the society.

It is said that hunting and gathering was the ancestral mode of subsistence or production of human beings, although the earliest humans lived as scavengers rather than as producers. Hunting and gathering presupposes language, knowledge about plants and animals, information sharing, tool making, social organisation, an understanding of the benefits of collaboration and sharing, and much more.

This period of social organisation, and all others since then, is usually described in terms of its outward appearances. Archaeologists find evidence of it and anthropologists attempt to piece together how such societies operated. There are some subsistence societies today that could still be described as hunter gatherers, and in the past few hundred years such societies have been extensively studied and written about.

What characterised these societies more than the fact that their members hunted and gathered their means of subsistence, was that they were organised along egalitarian lines and the predominant economic relationships were of collaboration and sharing.

Rules and practices evolved that prescribed how the product of combined effort was to be shared, distributed or allocated, and on that basis the members of the community decided what to hunt and what to gather and how these activities were to be organised. The motive of production was to share, not exchange. In sharing economies there is no need for accurate recording mechanisms for if most things are shared there is little need for explicit exchange.

This is not to say that there was no exchange among hunter gatherers. They frequently exchanged gifts, favours and the bounty of nature, but this was usually not because of specialisation. There is a natural desire for variety, and much exchange took place for reasons of prestige, sanction, bounty and love.

Despite not producing for exchange, hunter gatherers did have evolved exchange systems. These ensured that energies were evenly contributed and dispersed within the community and they also provided the motives for production.

The agricultural and herding societies that evolved from nomadic hunting and gathering brought about dramatic changes to the underlying exchange systems.

While these early agricultural societies were still predominantly subsistence oriented and thus had little reason for exchange or trade, the potential for trade was created by specialisation and the insecurity introduced by the sedentary lifestyle, which made farmers subject to the vagaries of climate-dependent agriculture. This encouraged them to live close to each other in villages, where seed and food supplies could be stored in containers and granaries for the lean years.

Granaries were collective storage facilities, which created the need to record contributions to and withdrawals from the storehouse. The surplus food supplies resulting from agriculture, especially after the invention of irrigation, meant that some members of the community were freed from farming and could manage the granaries, engage in administration and partake in other productive activities.

As agriculture became more efficient and the surplus of food grew, villages grew into towns that accommodated artisans and a scribe and administrative class that kept records of agricultural contributions and distributions. Granaries became independent of production and eventually fell under the control of the management class. The ability to control food supplies gave one section of society the power to control the majority, the food producers. This was the beginning of class society.

Control over food supplies and hence domination by a ruling class was largely achieved by controlling the means of exchange (contribution and distribution) rather than by taking control over the means of production. Instead of voluntarily contributing to granaries, agriculturists were obliged to deliver a proportion of their produce, and herders a proportion of their herd. And in lean times, instead of the surplus being redistributed according to contribution, farmers had to 'borrow' from the storehouses, leading to indebtedness and often slavery. Debt gave the ruling class even further control over the lives of the producing class.

Based on this arrangement, great civilisations arose in the fertile crescent (Mesopotamia), the Nile valley, eastern Mediterranean, Indus Valley, China and later in Mesoamerica. All of these civilisations used centralised accounting instead of exchange media to manage production, exchange, distribution and accumulation.

The economies of these civilizations and empires have been characterised as 'palace economies' or 'redistributive economies' where practically all production had to be delivered to centralised warehouses from where it was redistributed to the population. Through this arrangement, emperors supported by an elite administrative class were able to exert complete control over their respective societies.

The ruling classes acquired power by usurping control of the exchange mechanisms, then maintained that control by using them to keep the general population in a situation of dependence. This is the way that all ruling classes have acquired and maintained their power ever since.

These early civilizations and empires were all essentially agricultural societies but to understand how they operated and evolved it is far more useful to consider their modes of exchange (exchange systems) than their modes of production (economic systems). Economic systems increasingly became shaped by the prevailing exchange systems.

Their exchange systems defined how these societies were structured and operated, and provided the rules about what was produced, how it was produced and how it was distributed. The producers were motivated to produce not solely by their own needs, but according to the demands placed on them by those in control of the exchange mechanisms.

In much of the rest of the world where large-scale societies did not emerge, this was because there was either insufficient food surplus to feed a non-producing class, or conditions were such that there were no lean years and therefore no need to create and store surpluses of food.

Theories that have attempted to define the history of human society in terms of a series of modes of production have proved to be completely unsatisfactory when applied to parts of the world not on the same continent where these theories originated, namely Europe. By ignoring exchange systems and substituting in their place a constant that can be ignored (e.g. a money system), the true dynamic factor in economic evolution is excised.

Civilisations arose and disappeared in many parts of the world, and until Europeans colonised much of the world and imposed their economic systems on the local populations, herding and subsistence agriculture as well as hunting and gathering were still widespread. The same pressures that led to feudal systems and industrialisation in Europe were simply not there.

Categorising modes of production or economic systems is like categorising species, but to understand how species evolve there needs to be a theory explaining how they live in a system of co-dependency. The same applies to human societies. Without understanding the relationships that exist, how these relationships came about and the motivations of the members of the society, it is impossible to explain change or lack of it.

Functions of Exchange Systems

Exchange system only have meaning in a social context and do not apply to situations of spot trade between individuals. In spot trade there is no need for a system to memorise details of the exchange as one thing is exchanged for another at the same time, and the value of the items exchanged is expressed in terms of the other.

Exchange systems ensure continuity, making life a continuous cycle of giving and receiving, instead of it being a series of disjointed transactions that are complete actions in themselves. They blur the distinction between energy contributions and energy returns: something provided can either be seen as a new contribution to the social product or as a 'payback' for something received earlier.

Not all exchange systems perform the same functions but all share certain common features that define them as exchange systems. These are:

- A means to memorise or record contributions and distributions

- A means to measure the value of these contributions and distributions (unit of account/unit of value)

- Rules to ensure a balance between contributions and distributions

- Sanctions to prevent imbalances

- Measures to ensure that obligations to the community do not become too large

- Measures to ensure that claims on the community do not become too large

The recording function of exchange systems permits the separation of receipts and contributions in time. Something received from the social product can be 'returned' at a later time, either in one or several contributions spread over time.

It also allows those who have received something from the collective product to 'return' it to the collective 'pool' instead of to the particular individual or entity that provided it.

The above features are sufficient to ensure equitable exchange between close individuals or in and among small social groups where most effort is shared.

In addition to the above, more complex and dispersed societies require additional functions for an exchange system to be useful:

- A means to exchange multilaterally:

- Those who receive something should not be directly obligated to those who provide it, and those who provide something should not have to receive recompense directly from those they supplied it to.

- The ability to settle imbalances over a period of time:

- Those who receive something should not have to provide equivalent value immediately, and those who provide something should not require immediate recompense

- A means to defer claims for a long period (store of value)

- A means to transfer claims to others

- A means to transfer obligations to others

Types of Exchange Systems

Throughout history there have been many different exchange systems. As indicated above, exchange systems are both a product of the conditions in which a community or society finds itself and a defining factor that determines how the society operates and evolves.

An exchange system is a social facility. There is no system when just two people decide to exchange items, but when a social grouping adopts common practices, rituals or conventions, and creates rules and mechanisms to facilitate exchange, then it can be said that an exchange system exists.

As the notion of exchange systems is a fairly new one, the different types have not yet been categorised or labelled, and I do not feel compelled to do that here. However, in studying historical exchange systems it is possible to divide them into two different camps or general types. These are abstract headings under which to place identifiable exchange systems, but real-life exchange systems usually embody elements of both types:

- Information-based exchange systems

- Medium-based exchange systems

Medium-based exchange systems could be subdivided into Commodity and Token-based systems as there are considerable differences between them, but this is not a task that will be tackled here.

1. Information-based Exchange Systems

Information-based exchange systems are ones where exchange is organised or effected mainly by means of information. Information is used in recording or memorising exchanges or transactions. No exchange media are used although the information itself might be recorded by using tangible objects. The information keeps track of inputs and outputs and is used to ensure balance.

The information itself might range from pure human memory, through various accounting and recording systems to complex computer records.

Information-based exchange systems are the original type of exchange system, operating from the dawn of history before writing or numbers were invented. [The Credit Theory of Money, A. Mitchell Innes, The Banking Law Journal, Vol. 31 (1914), Dec./Jan., pp 151-168]

In the earliest societies contributions and distributions were simply recorded in the collective memory. As communities were small and life was uncomplicated, this was sufficient for many thousands of years. There is evidence that prehistoric communities used various mnemonic devices to keep track of exchanges and trades, such as notched bones, stones and pieces of wood. [See Wikipedia: Tally Sticks, http://en.wikipedia.org/wiki/Tally_sticks, Accounting, http://en.wikipedia.org/wiki/Accounting]

In subsistence communities where practically everything is shared - often called 'gift economies' - it is difficult to discern an exchange system in operation. However, even when gifting appears to be unconditional, expectations are generated by the gift and the recipient feels an obligation to return a similar gift at a later time, or to 'pay it forward' by gifting someone else. This ensures an even distribution of wealth in the community.

In these conditions there is no need for the accurate recording of value transfers because collective memory ensures that there is a rough balance between giving and receiving. Any able-bodied individual who does not contribute sufficiently in the eyes of the community will be ostracised or denied access to commonly produced wealth.

Gifting also allows the indirect transfer of value in conditions where there are no recording mechanisms (e.g. writing, numeracy, notions of accounting). The 'rules' relating to gifting vary from place to place but they do define the obligations of members of the community and restrain excessive claims on the collective product.

Exchange that takes place in subsistence communities where no exchange system seems to be in operation, is often called 'bartering'. This is an incorrect use of the word as most things in such communities are shared, and when something is given (gifted) there is usually no expectation of immediate or direct reciprocity. There is no negotiation about what is expected in return and usually notions of private property are weak or non-existent. This is not trade in the conventional sense as the parties do not confront each other in the hope of coming away from the transaction having exchanged value for equal value. Exchange is not driven by an urge to maximise self-interest but purely by a desire to be kept in the loop by sharing wealth.

The earliest societies and empires of the ancient near east and eastern Mediterranean - Mesopotamia, Sumer, Akkad, Assyria, Babylonia, Egypt, Greece and others - employed information-based exchange systems. This is where writing, numeracy and accounting originated. Many archaeologists have testified that there was nothing in these early societies that could be interpreted as exchange media (money). [Chadwick, John (1973). Documents in Mycenaean Greek (1st, 2nd ed.), p.198. Cambridge University Press.]

Highly evolved accounting systems were developed and records were kept with clay tokens and later on clay tablets. These tokens and tablets were not used for exchange purposes but for keeping records of inputs, outputs and inventories, and for recording credits and debts. The recording process was complex and required well-trained scribes.

Extensive information systems such as existed in those places could only work in highly centralised economies, where absolute control was maintained by kings and emperors. The centres of these empires were city-states, so there was little need for long-range information exchange. Practically all production took place within the perimeters of these city-states and was delivered to centralised temples, palaces or warehouses from where it was redistributed to the population. This permitted the central authorities to use the surplus to employ workers to engage in large-scale capital projects, and engage in warfare with other city-states.

Information-based exchange systems did not die out with the collapse of these empires and the development of medium-based exchange systems, but continued to exist in subsistence societies. As the majority of humanity lived in such societies up to the twentieth century, information-based exchange systems have a longer and grander history than medium-based ones.

Other civilisations and empires arose and fell, and many of these used information-based exchange systems. Notable was the Inca empire, which used knotted strings (quipus) for accounting and recording assets. No trace of any widely used exchange media has been discovered by archaeologists. [See: http://en.wikipedia.org/wiki/Quipu; http://en.wikipedia.org/wiki/Incas - Economy]

As the complexity of societies increased and trade between nations expanded, information-based exchange systems fell out of use because there were no effective means of long-distance information exchange. It became more convenient to use medium-based exchange where goods could be exchanged for something universally acceptable, such as gold.

It was not until the Internet revolution in the 21st century that extensive information-based exchange systems became viable again. With the ability to transfer huge amounts of information very rapidly and accurately to practically any location on earth, information-based exchange systems have largely made medium-based exchange systems redundant.

Since the beginning of this century there has been a dramatic growth of new exchange systems using information only. These do not require a central authority to create and issue an exchange medium, or even an electronic currency. They simply keep track of value transfers from providers to receivers and ensure that traders keep their 'balances' (the difference between values contributed and values consumed) within an acceptable range.

This makes these new exchange systems democratic in the sense that all users are equal and the opportunities to usurp control for private or sectarian ends are reduced or eliminated.

In a way, these new information-based exchange systems could take humanity full circle back to the egalitarian 'gift societies' that existed in earliest times, before exchange systems were hijacked by those who were entrusted with managing the reserves and surpluses of ancient societies.

2. Medium-based Exchange Systems

Medium-based exchange systems are ones where exchange is mediated by the use of physical or representative media acceptable to the trading parties. This means that real values in the form of goods and services are exchanged either for something else of real value, or for some token that allows the provider to obtain something of real value from someone else at a later time. The key feature is that things are not exchanged directly one for another but for something else that is equivalent to or represents the value of what was transferred.

Medium-based exchange is also as old as humanity. From the beginning of history, people overcame the inconvenience of exchanging one thing directly for another by using some other generally acceptable thing. For many thousands of years this 'other thing' was usually just some other commodity or object that the provider would accept in exchange because it could easily be exchanged with another party for what the provider really wanted.

The commodities used in local exchange would have been anything generally acceptable in the community, but when it came to trade with remote communities the range of commodities was considerably narrowed. However, certain commodities acquired universal acceptance and so became the standard or general exchange media. Gold and silver were at the top of the list of such commodities.

When two parties exchange directly with each other (spot trade or barter) or even if they use some random but mutually-acceptable medium, it is difficult to say that they are transacting within the framework of an exchange system. No societies have ever operated on spot trade alone and so such instances of trade usually fall outside of existing exchange systems.

It is only when specific media become widely accepted in exchange or are introduced specifically for exchange purposes, or when social mechanisms are introduced to permit one-to-one exchanges split by time, that an exchange system can be said to exist.

Money, as it is understood historically and today, falls under the heading of medium-based exchange systems. Money has no history separate from the history of exchange, in the same way that oil has no history separate from the history of energy. Countless books have been written about the origins and history of money as if it were some mysterious 'substance' that suddenly appeared in the human record. Practically every book on money explains it as an invention that was introduced to overcome the inconveniences of barter. It is often stated that before money all exchange was barter, just primitive peoples swapping one thing for another. Money, we are told, is the hallmark of civilisation and is responsible for the great economic advances brought about by capitalism.

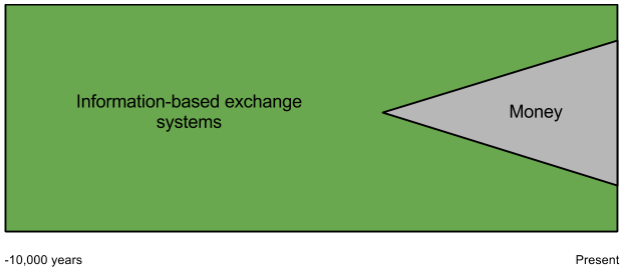

How monetary historians usually portray the history of exchange

True historians of money and many ethnologists and anthropologists have explained that there is no evidence of any historical society that had no systems of exchange, which is what societies engaging solely in spot trade (barter) implies. Barter can't be defined as any form of exchange that does not involve money, for as I have tried to explain above there are and have been many different exchange systems that do not use exchange media. Exchange, even complex indirect exchange, does not require an exchange medium to happen. [Primitive Money: In Its Ethnological, Historical and Economic Aspects, Paul Einzig, 1949, Part 2, Ch.6, p.364, Evolution of Barter] [Debt: The First 5,000 Years, David Graeber, 2011, Ch.2, The Myth of Barter]

Exchange systems that used generally acceptable commodities as exchange media cannot correctly be called money systems nor should they form part of the narrative of money. Those who used these commodities to facilitate exchange had no concept of money as we now understand it, and did not think of them as having special properties different from what they were actually exchanging. The generally acceptable commodities were for the most part not created and issued into circulation as dedicated exchange media. Specifically, the commodities that came to be used as exchange media were not provided by some entity outside of the normal circuits of exchange and trade.

Commonly used exchange media, usually termed 'commodity money', did not create markets and were only used as conveniences in exchange. Their usage was not compulsory, though when certain commodities began to be seen as being more valuable as exchange media than as consumable commodities, they did begin to take on special properties. Cattle, for instance, often came to be regarded as more valuable for their exchange value than for their use value. Sometimes huge herds of cattle were accumulated, way beyond the requirements of their owners, and this often led to land degradation and even the ruination of vast tracts of land. [A History of Money - From Ancient Times to the Present Day, Glyn Davies, 1994, pp.41-43]

In most histories of money, 'commodity money' is described as an early form of money. This is because the container concept is taken as money, instead of money itself being subsumed under the broader concept of exchange systems. When 'commodity money' is seen as just another type of exchange system or exchange aid, it loses its connection with money proper.

'Proper money' is also difficult to define because what has usually been called money has taken on many different forms throughout history. It is difficult to lump the first coins minted in Lydia in 600 BC with modern-day virtual currencies. However, what has generally come to be understood as money is something that has been created and issued into circulation for the express purpose of being used as an exchange medium.

This could embrace a huge range of specially created or collected objects: cowrie shells, whale's teeth, wampum, jewellery, carved stones and a vast array of other objects created specifically as exchange media. But again, if these objects are seen under the heading of exchange systems, it is better to see them as aids that were used to facilitate exchange in the communities in which they were accepted. They became valued as exchange media because of their rarity or curiosity values, but were in practice not much different to using valuable commodities.

The label money needs to be reserved for exchange media that have been created and issued into circulation by ruling classes. This makes money a political or class concept, rather than a universal or neutral one. The introduction of money assumes an already class-divided society, which would have come into being through a stratum of the society taking control over an earlier exchange system.

Using this definition, the beginning of money occurred around 600 BC with the invention of coinage in Lydia (southwest Turkey) and Ionian Greece. These coins were just flattened lumps of precious metal with the king's seal stamped on them. These markings guaranteed purity and weight, and so introduced the concept of standardised exchange objects of fixed value backed by the authority of the state. The names of Kings Midas and Croesus, associated with fabulous wealth, are linked to this innovation.

From Lydia and Ionia the knowledge and use of coins spread rapidly in all directions and got adopted by rulers in Greece, Egypt, Persia and possibly as far east as India. Coinage was invented independently in China at about the same time.

Far from coins just being a facility of convenience provided by kings for their subjects, they were used primarily as a means of social control and class dominance. [A History of Money - From Ancient Times to the Present Day, Glyn Davies, 1994, pp.61-64]

The prime motive for circulating coins was to create markets and monopolise trade. There is much evidence that coins were used by kings in order to lock their subjects into their realms. By demanding taxation, subjects were compelled to provision the king in order to obtain the coins to pay their taxes. To ensure 'loyalty', coins from other sources were forbidden, thus creating 'legal tender' for the first time. The king's realm could be determined by the area where his coins circulated. [Debt: The First 5,000 Years, David Graeber, 2011, Ch.3, Primordial Debts]

The creation and control of markets by the creators and issuers of money has always been the number one function of money, although this is never mentioned in books on money and economics.

Another way of saying this is that the introduction of money has always allowed the powerful to take control of the prevailing exchange systems and use them to exploit and dominate the producing classes. This is as true today as it was thousands of years ago. This fact has been hidden from view by treating money as one of the constants of the universe, and therefore something that can safely be taken for granted and ignored.

What needs to be emphasised is that money is not the only exchange system, nor have money-based exchange systems been around longer than other exchange systems. Even though the history of money can be traced back several thousand years, it was not the dominant exchange system until the 20th century. Even in regions where money became important, the majority of the population did not use it. Its main function was in long-distance trade and in the markets that came into effect in towns and cities, and only later spread into the countryside where the majority of the population lived.

The true history of exchange systems. Money is a recent innovation

Historians of money are incorrect in trying to explain the history of exchange in terms of money, and by subsuming exchange under the rubric of money. The conventional narrative would have us believe that before money there was only barter and chaos. Money, we are told, was invented to overcome the inconvenience of barter, but recent writings on the subject explain that no society ever existed where barter was the main exchange system. Far from coming before money, barter is in fact just an emergency mode of exchange resorted to when money-based exchange systems break down. Barter is only understood by those who have had prior experience of money.

Money is usually defined by its functions - medium of exchange, unit of account, standard of deferred payment, store of value etc. - and so anything that fits these criteria is called money. But these criteria are open to interpretation when money is put in its place under the umbrella of exchange systems and understood as a tool of class domination.

As an exchange system, money needs to fulfil the criteria required of exchange systems - listed above - before it fulfils the named monetary functions.

The 'medium of exchange' function of money is said to be its prime function, but when money is considered as a type of exchange system this is not a requirement. A medium of exchange is not required for direct or indirect exchange. However, by being a medium of exchange, money does fit the first requirement of exchange systems, which is that it is a means to record the transfer of values.

Exchange involving money does not require that a record be kept, but the exchange medium itself is a portable recording mechanism. Goods or services are provided to the receiving party, who gives a monetary instrument in exchange. The monetary instrument is a physical or token representation of the value of the goods or services received. This fits the second requirement of exchange systems that they must provide a means of measuring value transfers (this is the equivalent to the unit of account/unit of value function of money).

Money does fulfil most of the other requirements of exchange systems but these are not usually listed under the functions of money. Chief among these is the ability of money to facilitate indirect exchange. It is surprising that this is not advertised as one of the functions of money as the whole point of money, historians and economists tell us, is that it overcomes the limitations of direct barter.

The Shortcomings of the Money-Based Exchange System

Where money fails dismally as an exchange system is in its inability to comply with the important requirements of exchange systems to ensure balanced contributions and distributions and to sanction imbalances.

This inability is built into the design of money, because it was from the start designed to work as a tool of extraction rather than as a neutral mechanism to ensure the fair distribution of society's wealth. It enabled kings to requisition their requirements from the producing sector without having to maintain a cumbersome centralised bureaucracy to organise production and distribution.

The creation of markets created a self-running system that effectively channelled wealth to the ruling class, who were able to accumulate resources that allowed them to engage in large-scale projects and military expeditions.

The ability to create the means of exchange placed the rulers in an advantageous position relative to the producing sector. This impoverished one section of society and enriched another. Those empowered by money were then in a position to lend it and so create a second level of control through debt and dependency.

This structure is still built into the money system today. The only limits that apply are the ones affecting the producing class. The system is designed to funnel wealth to those in control of the exchange system, who are not faced by any limits.

Far from there being any sanctions against those who are parasitic on the collective body of wealth, imbalance is encouraged. In fact the pursuit of riches totally out of balance with contribution is advertised as one of the positive aspects of the monetary system. This is supposed to act as an incentive for the wealthy to invest in the system to provide jobs and services for the producing class. Imbalance is proclaimed as a sign of 'success' and becomes a goal for everyone living under the rule of money.

The failure of money-based exchange systems to comply with the requirement of exchange systems that they ensure balance and the equitable distribution of collectively-produced wealth, is a function of the fact that they have always been under private control or captured by special interests.

So long as the exchange system is operated for the benefit of the few who control it, the kinds of problems that are now being manifested as global crises will only worsen. It has become imperative now that exchange systems need to operate under democratic control. In the present context this does not mean under government control as governments themselves are part of the same structure that keeps the money system in place, which defines how global capitalism works.

What Comes After Money: That is the Real Question!

The main object of this paper has been to show that the development of human societies does not follow some pre-ordained linear path from hunting and gathering to capitalism and beyond. Theories that attempted to explain this path as a progressive movement from one stage to the next brought about by overcoming obstacles to the creation of increasing amounts of wealth, did not take into account the finite nature of the earth.

It also attempts to show that it is the exchange system that defines how an economic system works and evolves, not its mode of production. An economic system is the manifestation of a society producing its means of existence within the context of particular systems of exchange. If an economic system is to change, it is the 'operating system' that needs to change. The 'operating system' consists of the various exchange systems operating in a particular society.

There is no doubt that the path of evolution followed by Europe and exported to other parts of the globe has resulted in a massive unleashing of productive forces, but it has also unleashed massive crises. It is becoming clear now that continued movement along this path will result in disaster for all life on earth.

The main force that keeps humanity on its present calamitous course is not capitalism itself but its 'operating system', namely money - or as it is now termed in all its modern complexity, the financial system.

Capitalism, as its name implies, is 'money-ism'. That is, like all socio-economic formations before it, it is animated by the exchange system on which it rests. In this particular case the exchange system is not only money based, it is based on money in its particular 21st century guise. This is not money backed by a limited supply of precious metals, but a virtual money that has no real existence and is backed by nothing apart from trust, belief and confidence that it will continue being accepted in exchange. As recent events have shown, faith in this kind of money can evaporate in an instant and bring the entire global economy down with it.

The logic of present-day capitalism is derived from the logic of its exchange system, which is the logic of money in its current iteration. This is not money issued as an exchange medium but money issued as debt. Attached to the debt is interest, which introduces another dimension to the logic of the system, that of the need to expand exponentially. This is required in order to expand the total quantity of the exchange medium so that the repayment of the principal as well as the interest does not reduce the total supply of money.

As an instrument of class domination, the functions of money in the formative years of capitalism were different to the functions it has today. In the early years the money system was forced on communities that were largely self-sufficient and still reliant on older exchange systems. The object of money was to break the links with those exchange systems to force people off the land and into the capitalist market. This corralled them in cities where they became industrial workers and totally dependent on the market.

Money provided capitalists with the incentive to expand production, as the object of production was to create more money, which in turn could be used to create new capital to expand production even further. Workers were incentivised to seek money too because it became the source of life itself. Cities were built in such a way that workers could not provide for themselves, and so they were locked into markets for survival.

As the capitalist was in charge of the money flow, workers became totally dependent on their employers. Usually the power of capitalists over workers is explained as a consequence of their ownership of the means of production, but in truth that power is derived from the capitalist's control over the means of exchange. This is usually not recognised because the monetary relationship is taken as a given for all social formations and therefore ignored.

The money-based exchange system has now spread to all four corners of the earth and largely displaced other exchange systems, remnants of which only exist in small pockets. Even these are being consumed as money pervades every aspect of life everywhere. The money-based exchange system has spread laterally across the face of the earth and vertically within societies to displace exchange systems that at one time operated alongside the money-based one. Practically all of life is now organised according to the logic of money.

There are now hardly any more places for money to expand, and very few levels to expand within the societies that have already been captured. Money has come up against its own limits, and as it does so it consumes itself. An expansionary agent in a confined space can only result in an explosion.

The only place left for the expansion of money is in a virtual realm that exists beyond the real world of humans producing their means of life. This has resulted in a 'virtual economy' that is many orders of magnitude greater than the real physical one. This virtual economy sits atop the physical economy and extracts real wealth out of it, passing it to a new class of financial elites who have taken control of the money-based exchange system.

This financial elite maintains its power over society by keeping control over the exchange system. They do this by controlling the levers of credit (money), not by controlling the means of production. In this way they are the real power behind capitalism today. They keep control in the same way that emperors and pharaohs did by keeping control of their exchange systems, represented by their centralised systems of record keeping, palaces, warehouses, estates and debt.

Despite the fact that capitalism is coming up against physical limits, it appears that the financial limits it has reached will likely be the cause of its demise. There is plenty of evidence of impending financial collapse, even from the mainstream media. There is a growing perception that the system is kept going simply by a media that maintains confidence in the system. Once that breaks down there could be a rapid and disastrous collapse. [Systemic Breakdown? Financial Bubbles Creating Conditions for New Crash, Global Research, 21 May 2013]

As fears of a financial meltdown mount, calls for reforms to the financial system increase. Many believe that capitalism's exchange system can be fixed by regulating financial institutions. Others say that the exchange system should be managed by governments instead of private financial institutions. These are the 'greenbackers' who advise that governments should issue money debt-free into the economy, instead of banks doing it through debt-based loans. [The Web of Debt, Ellen Hodgson Brown, 2007]

Others say that money should be backed by precious metals so that unlimited amounts of it cannot be created out of fresh air, as is happening at present. Hyperinflation is the end result if there is no limit to money creation. [The Creature from Jekyll Island, G. Edward Griffin, 2002, p.574]

Then there are the ideological schools - anarchists, communists, socialists, greens, fascists and many others - who insist that we need a new economic system and claim to have already worked-out systems that could be implemented in capitalism's place.

None of these schools, however, argues for a replacement of the exchange system that currently underlies capitalism, for that exchange system (money) is taken as universal and constant and can therefore be ignored. Proposals for new economic systems never argue for a money-free exchange system but argue instead for reforms to the existing money system or for a centralised system of redistribution where currency is not required at all. [See: http://en.wikipedia.org/wiki/Economic_systems, http://en.wikipedia.org/wiki/Green_economy]

Ideologically-inspired plans for an economic system replacement geared towards minimising or reducing the impact of the converging crises, will inevitably fail if the expansionary logic of money is not removed. Monetary reforms may blunt some of the worst excesses of capitalism, but if these new economic systems employ money-based exchange systems, the drive for profit-making and growth and the dichotomy of money-providers and money-dependents will still be there. Markets will still exist and people will be dependent on them for survival, and the direction of society will still be decided by those in control of the exchange system.

An economic system capable of dealing with the looming crises will need to have some or all of the following characteristics or objectives:

- Economic contraction

This means that the exchange system must not be premised on growth, as dramatic degrowth is required to reduce the impact of the globalised economy on the environment. A new economy will be required to function in conditions of resource depletion and energy scarcity, and will thus need to be focussed on providing for the real needs of people instead of on 'making money'. - Reduction in scale

Energy and resource shortages imply that the scale of the economy needs to be cut back. Economic projects need to be reduced in scale to minimise their impact on the environment - Localised economies

The trend towards globalisation and unification of economies needs to be reversed. Economies need to be scaled back and economic projects need to be reduced in size. Big nations mean big economies with a huge impact; local economies mean smaller economies with less impact - Low energy usage

In a world of energy shortages the focus needs to be on smaller, sustainable economies. Industrialism needs to be reversed with a focus on local, small-scale production and natural, local food production - Low transport

In conditions of energy scarcity wasteful importation needs to be minimised. Urban transportation needs to rationalised and communities need to be localised so that commuting is minimised - Self sufficiency

Where transport is minimised communities will need to focus on local resources and production. Supply lines need to be shortened and dependency on remote resources and products needs to be reduced - Decentralisation

Localisation means decentralisation. Centralised systems of energy and food production are dangerous in the face of climate instability and the breakdown of supply chains - Market reduction

Markets trap people into unsustainable systems designed to benefit the money providers and are hostile to self sufficiency. Market reduction goes hand in hand with economic descent and the reduction in the size and power of economic entities - Egalitarian

An exchange system that cannot be hijacked to promote narrow interests needs to be introduced. This will prevent the use of economic resources for purposes that are harmful to others and the environment - De-politicised

An egalitarian exchange system is a de-politicised exchange system. This means it is not used as a tool of class rule and empowerment but as an instrument for the community control of collective resources and efforts - Stability

A new, democratic exchange system that reflects economic activity instead of determining it will prevent destructive economic cycles and imbalances

An economic system geared towards the production of a single 'product' - money - and which uses real products and services as its 'currency', is not going to be able to address many of the above objectives. All of the above assume downscaling and a reduction of economic activity whereas the logic of money is and always will be in the other direction.

Experiments in alternative exchange systems have demonstrated that it is possible to create effective exchange systems that will address the above. Passive exchange systems that facilitate economic activity but do not drive it will be able to cope with degrowth and a reduction in the scale of economic systems. Other exchange systems such as organised swapping, bartering, gifting and sharing can be used in combination with various currency-free recording systems to create a multi-dimensional exchange system that will serve as the foundation for a more environmentally-friendly and resilient economic system.

Community-based exchange systems keep economic activity local and encourage the growth of non-competitive, small-scale enterprise. This breaks down markets, reduces the size and scope of economic projects and encourages co-production.

By keeping these exchange systems open, transparent and democratic, the opportunities for using or taking control of the exchange system for promoting narrow sectarian interests is eliminated. This means economic policy will be community oriented instead of class biased.

Where exchange is facilitated through an information-based exchange system, no party to a transaction is advantaged in the way that buyers are advantaged in a medium-based exchange system. In the latter, the buyer can withhold or delay the exchange medium (payment), which the supplying party (seller) requires in order to acquire their means of life or to continue producing. With an information-based exchange system all that needs to happen after there has been a transfer of value from a provider to a receiver, is that a record of the transaction needs to be made. If it is the provider (seller) who does the recording, the receiving party (buyer) has no sway over the situation. The provider is immediately credited and the receiver is debited at the same time.

The relationship of workers to employers is likewise evened by removing the power of control inherent in money. Under capitalism workers are placed at a disadvantage relative to their employers because the exchange system gives the latter the power over their workers by being able to determine their worth and by being the dispensers of their means of life (money).

In an information-based exchange system the provider of services (employee) is the 'seller' and the receiver of services (employer) is the 'buyer'. This entitles the employee to record the transaction and thereby credit themselves. This neutralises the relationship of the employer to the employee. Employees are no longer beholden to employers for their means of life; they are entitled to access it by having recorded the values they have delivered.

The creation of locally-bounded exchange systems does not mean the elimination of remote trade. Local economies will still be able to trade with others, but such trade will also be subject to the same kind of balance mechanisms that apply to individuals.

--

This paper makes a case for alternative exchange systems, particularly information-based ones, seeing them as offering solutions that cannot be provided by reforms to the current money-based exchange system. Capitalism cannot be reformed because it is an economic system based on money. Money, as a system of wealth extraction under class control, will never transform into a democratic economic system, let alone one that needs to be scaled down in the face of the converging crises.

Alternative exchange systems need to be seen in their own right and not as complementary systems operating alongside the mainstream system. So long as alternative exchange systems are seen as 'complementary currencies' designed solely to soften the blows of capitalism and serve as 'lifeboats', they will remain insignificant.

Alternative exchange systems that build local economies and offering a wide range of goods and services will be eagerly adopted in the communities in which they appear, especially in areas where the regular economy is showing signs of systemic breakdown. If they can be shown to be democratic and as providers of community resilience they offer great hope for providing alternatives to capitalism.

« Back